European Investment bank - EIB

The European Investment Bank (EIB), for instance, has identified energy efficiency finance as one of its priorities. It offers multiple instruments to both public and private sector, including dedicated credit lines through local financial intermediaries or direct framework loans to promote projects. EIB also manages and/or co-finances several funds and facilities, such as

- European Fund for Strategic Investment

- Private Finance for Energy Efficiency (PP4EE)

- European Energy Efficiency Fund

- Municipal loans

European Fund for Strategic Investment (EFSI)

EFSI is an initiative launched jointly by the European Investment Bank, European Investment Fund and the European Commission to help overcome the current investment gap in the EU. EFSI is one of the three pillars of the Investment Plan for Europe that aims to revive investment in strategic projects around the continent to ensure that money reaches the real economy.

EFSI is a EUR 26 billion guarantee from the EU budget, complemented by a EUR 7.5 billion allocation of the EIB’s own capital. The total amount of EUR 33.5 billion aims to unlock additional investment of at least EUR 500bn by 2020. EFSI is implemented by the EIB Group and projects supported by it are subject to usual EIB procedures.

With EFSI support, the EIB Group is providing funding for economically viable projects, especially for projects with a higher risk profile than usually taken on by the Bank. It focuses on sectors of key importance for the European economy, including:37

- Strategic infrastructure including digital, transport and energy

- Education, research, development and innovation

- Renewable energy and resource efficiency

- Support for small and mid-sized businesses

To benefit from EFSI resources deployed through the EIB, the projects need to undergo the standard EIB due diligence process. This process helps to verify if your project is eligible for EIB financing. If it is and the operational department proposes that it be backed by EFSI, it will be presented to the independent Investment Committee to decide on the use of the EU-guarantee.9

In particular, EFSI projects need to be:

- Economically and technically sound

- In at least one of the EFSI eligible sectors

- Contributing to EU objectives, including sustainable growth and employment

- Mature enough to be bankable

- Priced in a manner commensurate with the risk taken

Link - How to apply for EFSI financing

Private Finance for Energy Efficiency (PP4EE)

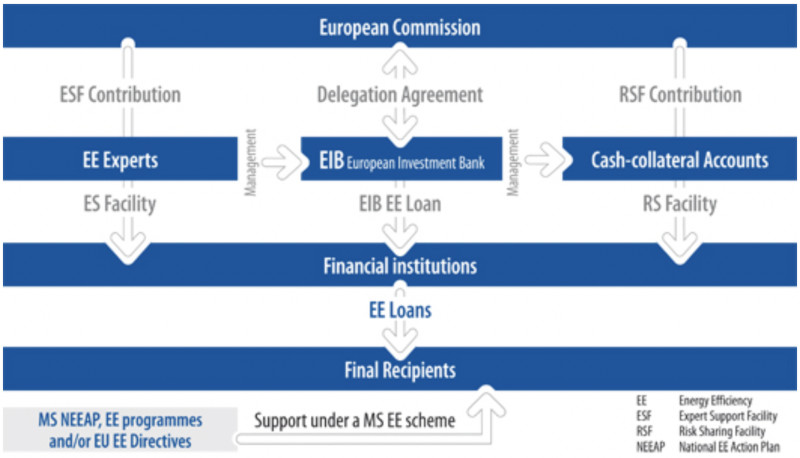

Private Finance for Energy Efficiency (PF4EE) instrument is a joint agreement between the EIB and the European Commission which aims to address the limited access to adequate and affordable commercial financing for energy efficiency investments.

The instrument targets projects which support the implementation of National Energy Efficiency Action Plans or other energy efficiency programmes of EU Member States.

The PF4EE instrument’s two core objectives are:

- to make energy efficiency lending a more sustainable activity within European financial institutions, considering the energy efficiency sector as a distinct market segment,

- to increase the availability of debt financing to eligible energy efficiency investments.

The instrument is managed by the EIB and funded by the Programme for the Environment and Climate Action (LIFE).

The LIFE Programme committed EUR 80m to fund the credit risk protection and expert support services. The EIB will leverage this amount, making a minimum of EUR 480m available in long term financing.

The PF4EE instrument provides:

- a portfolio-based credit risk protection provided by means of cash-collateral (Risk Sharing Facility)

- long-term financing from the EIB (EIB Loan for Energy Efficiency)

- expert support services for the Financial Intermediaries (Expert Support Facility)

One PF4EE operation shall be implemented per country. The EIB has already signed an operation in the following countries - the Czech Republic, Spain, France, Belgium, Italy, Portugal, Croatia, Greece and Cyprus.38

European Energy Efficiency Fund (eeef)

EEEF is an overlapping tool that belongs to both Intermediaries and funding sources, for more the Chapter 2.1.3 of this document.

Municipal loans

Municipal loans are another financial tool provided by the EIB. In principle, there can be two basic types of these loans:

- Investment loans for single large investment projects

When a single large investment project needs long-term funding, the European Investment Bank (EIB) can provide dedicated project-specific loans, which are known as Investment loans. EIB lends to individual projects for which total investment cost exceeds EUR 25m. EIB support is often the key to attracting other investors. These loans can cover up to 50% of the total cost for both public and private sector promoters, but on average this share is about one-third.39

- Multi-component loans

Multi-component leans are the loans for financing multi-component, multi annual investment programmes using a single “framework loan”. This funds a range of projects, usually by a national or local public sector body, most frequently regarding infrastructure, energy efficiency/renewables, transport and urban renovation.

The project must be in line with lending objectives and must be economically, financially, technically and environmentally sound. Financing conditions depend on the investment type and the security offered by third parties (banks or banking syndicates, other financial institutions or the parent company).

Interest rates can be fixed, floating, revisable or convertible (i.e. allowing for a change of interest rate formula during the lifetime of a loan at predetermined periods).40