Self-financing and alternative schemes

Besides external sources on European or national level there is a great variety of financing schemes that can be utilised for financing energy efficiency projects. As the above-mentioned European and national sources for financing energy efficiency depend on political environment and are subject to change in the course of time, it is highly advisable to utilise these self-financing and alternative sources to a greater extend as it used to be so far. This section would like to shortly introduce suitable alternative schemes only to put some of them in a context of concrete examples of energy efficiency financing in the Chapter 3 of this document.

The following list of self-financing and alternative schemes is rather indicative than exhaustive as the variety is great and they may be sometimes also combined with each other:

- Citizen cooperatives

- Crowdfunding

- Energy Performance Contracting

- Green municipal bonds

- On-bill financing

- Revolving loan funds

Citizen cooperatives

Citizen cooperatives can be defined as cooperatively-owned renewable energy projects whose financial revenues stay within the local community. One of their important roles is transforming from a centralised market dominated by large utilities to a decentralised market with millions of active energy citizens. Without active involvement of citizens and their participation on benefits coming out of cooperatives this energy transition is not possible.

More concretely, after purchasing a cooperative share and becoming a member or co-owner of local RES and EE projects, members share in the profits and often are given the opportunity to buy the electricity at an affordable/moderate price. In addition, members can actively participate in the cooperative. They can decide in what and where the cooperative should invest, and are consulted when setting the energy price.9 27

A detailed description of this model including a model example is available in the Chapter 3.4 of this document.

Crowdfunding

Crowdfunding is the collective effort of a large number of individuals who network and pool small amounts of capital to finance a new or existing business venture. Each campaign is set for a goal amount of money and a fixed timeframe, each day is counted down and the money raised will be tallied up for visitors to follow its success. The number of crowdfunding platforms worldwideis on the increase.8

Crowdfunding for sustainable energy and climate projects is the natural extension of the citizen cooperative model to even larger communities. With the help of the internet, crowdfunding can draw support from people across entire countries and increasingly internationally. A detailed description of this model including a model example is available in the Chapter 3.5 of this document.

Energy Performance Contracting

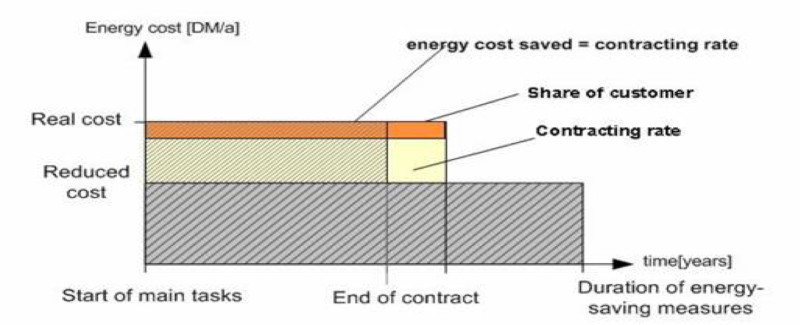

Energy Performance Contracting (EPC) is a form of creative financing for capital improvement which allows funding energy upgrades from cost reductions. Under an EPC arrangement, an external organisation (Energy Service Company - ESCO) implements a project to deliver energy efficiency, or a renewable energy project, and uses the stream of income from the cost savings or the renewable energy produced to repay the costs of the project (including the costs of the investment). Essentially, the ESCO will not receive its payment unless the project delivers energy savings as expected.

The approach is based on the transfer of technical risks from the client to the ESCO based on performance guarantees given by the ESCO. In EPC ESCO remuneration is based on demonstrated performance; a measure of performance is the level of energy savings or energy service. EPC is a mean to deliver infrastructure improvements to facilities that lack energy engineering skills, manpower or management time, capital funding, understanding of risk, or technology information.30

A detailed description of this model including a model example is available in the Chapter 3.3 of this document.

Green municipal bonds

Bond is a debt investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or fixed interest rate. Bonds are issued by companies, municipalities, states and sovereign governments to raise money and finance their projects and activities. Green bonds are all those instruments which are used exclusively to fund qualifying green investments. They can be made attractive via tax-exemptions.9

More detailed info on green municipal bonds available in the Chapter 3.6 of this document.

On-bill financing

On-bill lending is a method of financing energy efficiency improvements that uses the utility bill as the repayment vehicle. Energy suppliers collect the repayment of a loan through energy bills. It leverages the relationship, which exists between a utility and its customer in order to facilitate access to funding for sustainable energy investments.9

More detailed info including concrete example of on-bill financing available in the Chapter 3.7 of this document.

Revolving loan funds

A revolving loan funds are defined as sources of money from which loans are made for multiple sustainable energy projects. Revolving funds can provide loans for projects that do not have access to other types of loans from financial institutions, or can provide loans at a below-market rate of interest (soft loans).9

BOOSTEE-CE consortium identified 2 best practice examples of multiscope funds financing energy efficiency on regional level. More detailed info on these models of financing available in the Chapter 3.8 of this document.