General principles & popularity of specific models

3.1.1 General principles

The suitability of EE projects and activities financing model depends on its specific advantages and disadvantages, as well as on the existing economic, market and legal conditions. Large industrial region with many inhabitants will target different goals and options than small rural municipality with a couple of thousands of inhabitants. Therefore, the adequacy of a model chosen depends on the specific characteristics of the municipality or region. Some of the key considerations in choosing a financing model are the availability of own resources; the municipality’s borrowing capacity, project size and bankability; the maturity of the market of energy service providers and energy service companies (ESCOs); and, finally, policies at European Union (EU), national and sub-national levels and financial incentives. 36

Availability of public funding

Public funding in the form of national or European programmes is commonly the first option municipalities and regions are searching for and applying for as it provides finance at the lowest cost compared to resting commercial options and, last but not least, smaller risk of a financial failure. This option is mainly suitable for such public projects whose risk profile or size are not interesting for private investors and have a potential to get funding from these programmes.

Depending on the funding source, municipalities can use it to finance project costs directly or to design a revolving scheme to multiply and leverage additional private capital. National incentives and policies like energy efficiency obligation schemes offer an option to finance energy efficient projects with the help of utilities or other actors participating in the scheme. If available public funding is not sufficient, municipalities can consider working with the private sector and commercial finance providers.

Bankability and availability of commercial financial instruments

By definition, the project is bankable if it has as sufficient collateral, future cash flow, and high probability of success, to be acceptable to institutional lenders for financing.41

The larger the project is the higher the need is for an external funding and a private sector engagement. Also, complexity of financing arrangements may increase with the project size. To obtain a commercial debt the projects need be financially sustainable. Furthermore, municipality should have a credit profile and decision-making authority allowing to obtain debt on the municipality’s balance. The cost of capital depends of the project profile, type of financial instrument and maturity of the local financing sector.

In contrast to public funding, private investors have specific risk-return requirements for projects. Investments into energy efficiency may have very variable forms and each one needs to be pre-evaluated properly regarding the technology required, generation of savings, payback period etc.

Energy efficiency projects are usually interesting for energy service companies(ESCOs) or other private investors. Other financial instruments are available as well and they are increasingly being used, e.g. citizen cooperatives, crowdfunding, green municipal bonds, on-bill financing, revolving loan funds.

Maturity of the ESCO and energy service providers market

If ESCOs and energy service providers are active on the country market, they can offer advantageous terms for energy performance contracting (EPC). To be attractive for ESCOs, the projects must deliver high energy savings and municipalities need be able to pay the contract fees over time. Using ESCOs or other service outsourcing models allows implementing EE projects without peaks in budget spending and with transferring investment risks on the private partner. However, if the ESCO market is not mature enough or the project does not offer sufficient scale, energy savings or payback period for ESCO interest, other debt-instruments need to be explored.36

3.1.2 Popularity of specific EE financing models

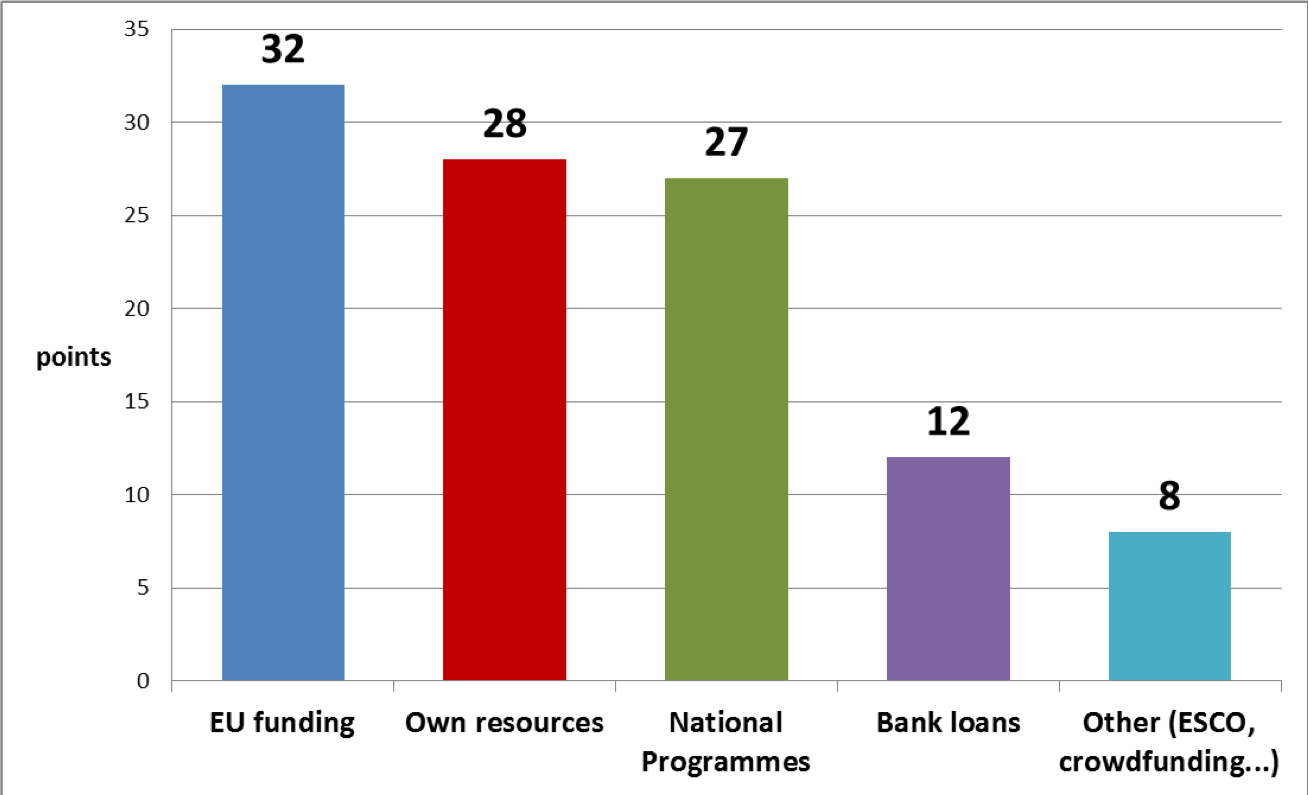

The survey was carried by BOOSTEE-CE consortium on the opinion of EE projects implementing bodies about effectiveness of EE financing models. The result of the survey reflects the common situation when the most used and therefore the most popular and effective are considered to be conventional ways of EE financing which are funding from EU programmes or grants from programmes on national level, eventually self-financing through energy savings.

As the following graph reveals, the combination of self-financing with European funds and national programmes is the most popular and used model of EE financing by far. The main reason for this situation is a wide availability of grants on both European and national level. As a result, the alternative financing models are for municipalities and regions only a marginal option and the market with these alternative schemes is many times not well developed or mature.

However, in the future these public sources might not be available in such a range and amount as they are nowadays and municipalities should definitely look for the extension of their of EE financing models portfolio.

Popularity of energy EE financing models

Following chapters 3.2 – 3.8 describe particular mapped models of EE financing with the aim to specify the models as closely as possible (but also in a concise way) on concrete examples, where possible.