Energy Performance Contracting

The classic and commonly used method of financing an investment is that an investor engages his own financial resources or invests a loan of up to 70-80% of the investment's value in the bank for the project. It is also required that the investor has knowledge about what to do and how to achieve planned effects. But what can you do if the above conditions are not met, and there is an intention of an investment project that reduces the cost of energy supply of the facility? Well, the market has developed companies with technical and financial profile, willing to invest in projects reducing the consumption and energy costs of its user in exchange for a share in the profit (savings) created by this investment. The investing company is ESCO (Energy Saving Company or Energy Services Company), and the term third party refers to an external financial institution providing additional financial support to ESCO. This is where the name of this method comes from, i.e. third party funding (TPF).

ESCO investment and payback scheme

What has been written above is the idea of this system, but there have been many varieties of contracts concluded with ESCO. The basic division concerns the type of implementation of investment projects, among which we distinguish:

BOO (Build - Operate - Own)

There is permanent involvement of the ESCO from the investment phase to the permanent operation and possession of the completed investment (e.g. built facility or installed equipment), this system boils down to the purchase of a specific energy service by the investor, for example ensuring proper temperature in the room.

BOT (Build - Operate - Transfer)

After the construction of ESCO, the investment is used in the initial period of time and then it is transferred to the investor.

BOOT (Build - Own - Operate - Transfer)

Similar to BOT but the service life is extended, and it is the combination of the previous two variants (BOT and BOO).

Other keywords that often appear in this way of financing are:

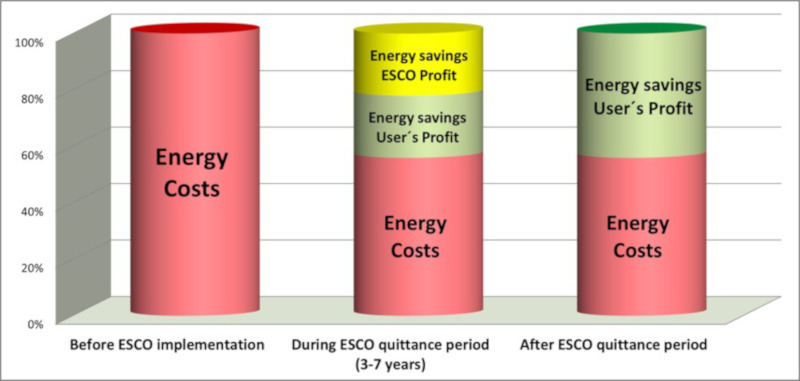

Agreement on the energy effect (EPC, Energy Performance Contracting): is an agreement that guarantees the investor to achieve the savings declared by ESCO, these savings are allocated to the repayment of ESCO's investment costs (ESCO receives remuneration only after achieving savings calculated according to the agreed procedure).

First repayment (first out): EPC variant, where all savings are only allocated to the repayment of investments (shortening the repayment period to a minimum).

Sharing of savings (shared savings): EPC variant, where the investor partly participates in savings from the beginning (extension of the total repayment period, but the investor immediately notes the positive economic effect of the completed investment).

The most common two variants of contracts are the energy service of the recipient (BOO) and the investment in energy saving (BOT + EPC). In summary, compared to other financing methods, the third party financing method provides the following basic benefits:

- project, to connect the cities, business and industrial The investment is carried out without the client's financial commitment

- The ESCO has full responsibility for implementing the project and obtaining results

- All technical services and financing of investments are carried out by one entity

- It is not required for the energy recipient to have a special technical knowledge

- An additional package of services for the recipient: training, extended service and maintenance 2 3 4 5

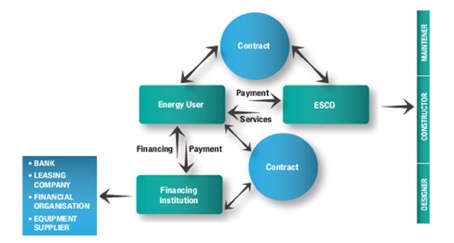

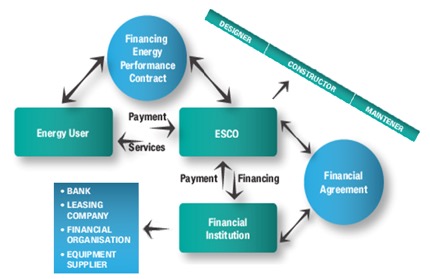

ESCO model

ESCO is an attractive way to finance projects related to energy efficiency. It is an action model in which companies specializing in solutions to improve energy efficiency offer implementation of various projects that reduce energy demand without the need to involve clients' investment budgets. Cooperation with an ESCO company allows you to implement energy-efficient investments in the best possible way and removes the necessity of incurring many different risks – e.g. financial or technical risks. Picture 18 illustrates the operation of the ESCO model.

The ESCO offer includes:

- technical consultancy,

- project management including supervision over the implementation and operation of the undertaking,

- project financing,

- performance guarantee,

- analysis of the level of savings,

- risk management,

- monitoring of results,

- exploiting and taking care of the level of savings or guaranteeing the repayment of savings.

ESCO offers two main types of contracts for energy services: contracts for energy savings, i.e. ESPC (Energy Saving Performance Contracting) and contracts for obtaining relevant energy efficiency parameters, i.e. EPC (Energy Performance Contracting).

The Guaranteed Saving Model (see picture 19) is termed so because the ESPC comprises performance guarantee by the project implementing ESCO. Third party lender finances the project and the facility owner provides it with recourse to their balance sheet. Therefore creditworthiness of the owner is a necessary condition. The owner in turn has recourse to the ESCO’s guarantee and is able to share some risks of the project. After repayment of loans and project payments to the ESCO, the owner earns the realized savings from their energy bill which effectively constitute the investment returns. It is also possible that the lender requires a guarantee from the ESCO for its payments. Guaranteed Savings Model (ESPC) is characterized by the fact that facilities owner takes out loan, ESCO company guarantees loan can be repaid with savings, ESCO pays difference if minimum savings not met. Main advantage is that ESCO can undertake more projects.

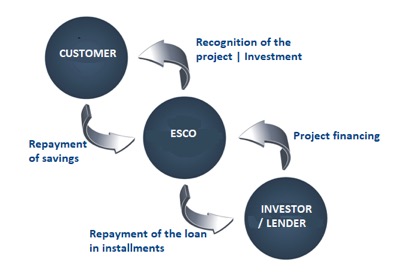

In the Shared Saving Model (see picture 20), it is the ESCO who invests in the project and assumes higher risk than the facility owner. This type of model is particularly helpful in case where the creditworthiness of the facility owner is an issue. One mitigation arrangement is to create a separate escrow account under the contract. The owner pays up all accrued saving into this account and all repayments of finance are channeled through it. Third party, who may lent to the ESCO, would normally have the first access to this account. Thereafter, ESCO receives its payment (an agreed percentage of the savings) and any excess is availed by the owner. However, unlike the first case, this last share of accrued savings to the owner is not guaranteed. Shared Savings Model (EPC) is characterized by the fact that facilities owner does not take loan, project is financed by ESCO company that takes performance and credit risk, facilities owner pays higher percent to ESCO. Main advantage is an independent of facilities owner’s borrowing capacity.

There are four basic types of EPC contracts that differ from each other in the financing method and the risk division between the ESCO and the client and the profits from the implemented investment:

- Contracts in which ESCO offers financing, while giving the client a guarantee of savings (he thus bears almost the entire investment risk).

- Agreements in which the client / owner is responsible for financing, and the ESCO guarantees energy savings (the risk is divided between the parties to the contract).

- Agreements providing for the total assignment of ESCOs to savings in respect of reduced energy costs, up to the total repayment of the investment.

- Energy management contracts based on which the ESCO receives payment for the provision of an energy service.

The growth of the ESCO model development is favored by the existing regulations on energy efficiency, which allow ESCOs to conclude contracts by ESCOs. At the moment, the biggest barrier to

the development of the ESCO market is the lack of a state guarantee system for contracts with debt financing on market terms, which significantly increases the cost of capital, collateral possibilities and affects the lack of profitability of projects in such a model. The ESCO model is a solution for those looking for energy-related savings who do not want or can not engage their own financial and personal resources in the required modernizations, enabling them to reduce the cost of equity from around 13-15% to 2-4%.

As the example of successfully implemented ESCO approach the best practice from Judenburg in Austria was identified by BOOSTEE-CE consortium:

District heating grid based on waste heat from pulp & paper mill Zellstoff Pöls AG

The Zellstoff Pöls AG annually processes approximately 2 million cubic meters of thinning wood and sawn timber into both pulp and paper. Together with the know-how partner „Bioenergie Wärmeservice Gmbh”from Köflach, an expert for district heating and waste heat recovery systems, a joint venture was formed into the company “Biowärme Aichfeld Gmbh”. The objective was to use the waste heat sensibly, in combination with an existing biomass heating plant and a storage solution with large-district-pressure reservoirs. The result allows for a sustainable, environmentally friendly and regional heat supply for more than 15,000 households in the greater Aichfeld area.

For this purpose, the joint venture partners invested €18 million and laid over 18 km of piping for the district heating project. This is a heat grid infrastructure parks in the region. The cities, business and industrial parks are served by ESCOs, which take over the heat from the infrastructure heat grid, and distribute the heat to the customers.

Best practice Factsheet #9 to this projectis available on the BOOSTEE-CE OnePlace platform, in the section Financing Energy Efficiency and involves comprehensive information on the measures of the action, partners’ involvement, financial details etc.