Leasing

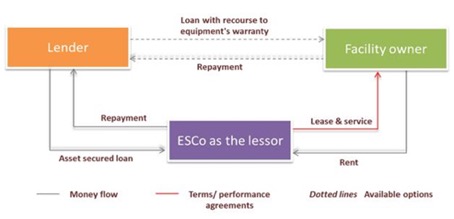

Leasing is another form of support targeted at investments aimed at improving energy efficiency. When energy efficiency project involves installation of equipment, lease finance as an option can be explored with the ESCO as the lessor (see Picture 27). As with any other lease, lesse i.e. the facility owner pays a fixed rent for new installations for pre-agreed period and amounts. The ESCO avails secured loans for purchasing tools and equipment and the balance of lease rent and loan repayment are its returns. Surplus in the savings on energy bills of the facility owners are retained by them.

As part of the leasing, the lessor (lessee) transfers the right to use a certain item to a lessee for a certain period agreed in a leasing contract, in exchange for installment installments consisting of two parts: capital reflecting the value of the object used for the period of leasing and interest, constituting remuneration for the lessor.

Leasing combines elements of credit and leasing. The lessee uses an EE device on terms strictly specified in the contract. The subject of the lease does not become its property during the term of the contract - it is only made available for a limited period. After the end of the lease agreement, the lessee can buy the leased device, and the buyout amount will be much lower than its market value.

The benefits of leasing for the lessee is a small commitment of own capital, optimization of tax burdens, the possibility of VAT settlement. Like any type of financing, leasing has both advantages and disadvantages.

Pros of leasing:

- the possibility of reducing the tax by including the lease payment in the tax deductible cost,

- the ability to determine the amount of installments,

- does not affect the reduction of financial capacity,

- simplified leasing procedures,

- no complicated security.

Cons of leasing:

- finances only tangible and intangible assets,

- the item being used is not owned by the company,

- rigid rules defining the duration of the contract.

Operational and financial leasing are the best leasing options for managers and building owners.

Operational leasing consists in temporarily transferring the investment good into use. Lease payments represent the tax-deductible cost for the lessee, and the subject of the lease is not amortized. VAT is charged gradually, including each installment. A leasing contract is concluded for a minimum of 40% of depreciation time of a fixed asset.

Financial leasing consists in putting things into use in exchange for leasing installments. The subject of the lease is the property of the Financing Party, it is amortized by the lessee. At financial leasing, the whole tax should be paid along with the first installment of the lease, and only the interest on the installments is added to the tax deductible costs, and not the entire installment. A depreciation charge can be made. A leasing contract is for a definite period, but without a minimum duration. The VAT on leasing installments is payable in advance for the entire duration of the lease agreement (usually within 7 days after receipt of the leased asset). After paying the last lease installment, the lessee must decide if he wants to buy the leased device.

The form of leasing as financial support is practiced in the PolSEFF Leasing program by the European Bank for Reconstruction and Development in cooperation with financial institutions. As part of PolSEFF Leasing, a credit line with a value of EUR 250 million was made available at banks and leasing institutions. As part of the program, you can lease devices located on the so-called LEME lists, or a list of devices that meet the energy efficiency criteria. The list is available on the PolSEFF program website (www.polseff.org). All machines and devices from the LEME list are to guarantee at least 20% energy savings. Among products in the field of renewable energy sources that are on the LEME list are solar collectors, pellet boilers as well as bioelectric plants. The LEME list is open. Companies and investors can apply for its extension and submit devices or materials in the technology categories available on the website.

Projects that are eligible to participate in the program are:

- investments in the purchase and installation of materials, machinery and equipment from the LEME list

- investments in energy efficiency in equipment, systems and processes enabling reduction of energy consumption by min. 20%

- thermo-modernization projects of already existing commercial, residential or public buildings, including the use of renewable energy sources in them, enabling min. 30% energy savings.