Green municipal bonds

A green municipal bond is a fixed-income financial instrument for raising capital through the debt capital market. As with any other bond, the bond issuer raises a fixed amount of capital from investors over an established period of time (the “maturity”), repays the capital (the “principal”) when the bond matures, and pays an agreed-upon amount of interest (“coupons”) during that time.

The key difference between a green bond and a regular bond is that the former is explicitly labelled as “green” by the issuer, and a commitment is made to use the proceeds of the green bond to exclusively finance or re-finance projects with an environmental benefit. Eligible projects include, but are not limited to, renewable energy, energy efficiency, sustainable waste management, sustainable land use, biodiversity conservation, clean transportation, clean water, and various climate adaptation projects.31

As the green municipal bond market grows, it is important that issuers understand the process of issuing green bonds before entering into a transaction. Generally speaking, issuing a green municipal bond involves five phases:32

- Identifying qualifying green projects and assets. Municipalities, city governments, andstates should first define the kind of green projects they seek to support with green bonds, while clearly stipulating that the proceeds from the green bond sale would be earmarked for green projects or assets.

Similar to the process of re-financing, proceeds of a green bond can be applied to existing assets, such as public transportation assets. For instance, a municipality can issue a green municipal bond to refinance an existing metro rail line project and use the funds to repay or increase the existing financing for the rail line. Proceeds can also be allocated to upcoming capital investment, though investors generally prefer that the funds are used within a reasonable period in order to achieve green impact in a timely manner.

Guidance about qualifying projects and assets can be obtained from the Green Bond Principles,44 which set out broad green asset categories, and the Climate Bond Standards Scheme,45 which sets out more specific standards for what qualifies within these asset categories.

- Arranging independent review. Issuers ofgreen municipal bonds should use independent review to further increase investor confidence in funded projects. Ultimately green investors want to make sure that their investment is being used to support genuinely green projects. Independent reviewers look at the green credibility of the proposed green municipal bond investments and the processes established for tracking funds and for reporting. Independent reviewers can also help identify green projects and assets, and help set up a green bond framework for the issuer.

Different independent review options are available that vary in terms of their rigor and level of assurance. Issuers can engage a consultant with climate expertise to undertake second-party consultation on eligible green projects and choose whether to make the results of the consultation public. A more rigorous approach involves engaging an expert consultant or auditor to verify the criteria and processes in place for tracking proceeds, evaluating environmental outcomes, and preparing reports. The latter approach is generally conducted in line with professional standards such as the International Standard on Assurance Engagements 3000 (ISAE 3000) to ensure the integrity and independence of the review.46 - Setting up tracking and reporting. It is critically important that issuers of green municipal bonds always maintain full disclosure on the allocation of proceeds. A few key rules should be kept in mind:

- Since the proceeds from green municipal bonds must be used only for specified projects, there should be systems in place to segregate green municipal bond proceeds and keep track of their use

- Monitoring procedures must be set up to make sure proceeds are not placed in non-green investments throughout the life of the green bond.

- The nominal value of the pool of assets or projects must stay equal to or greater than the amount of the bond. Municipal issuers should be tracking all this and also be able to show how they are tracking; transparency is essential.

- Issuing the green bond. As with any conventional bond, issuers of green municipal bonds will follow the usual steps. They should first seek required issuance approval from regulators. Second, working with an investment bank or advisor, they should structure the bond. Any sort of structure, from vanilla bonds to asset-backed securities, can be used as long as proceeds are allocated to green projects or assets. Finally, they should market and price the green municipal bond. It should be noted that creditworthiness is judged the same as for other bonds. Issuers should expect to get credit rated in the usual manner. Currently 82 per cent of the labelled green bond market is investment grade.

- Public letter from the municipality auditor or a letter signed by an authorized officer of the municipality.

- A brief report that sets out the ongoing use of the Green Muni Bond proceeds, highlighting the environmental impact to investors and other stakeholders. Reports should be publicly available, such as on the issuer’s website. 32

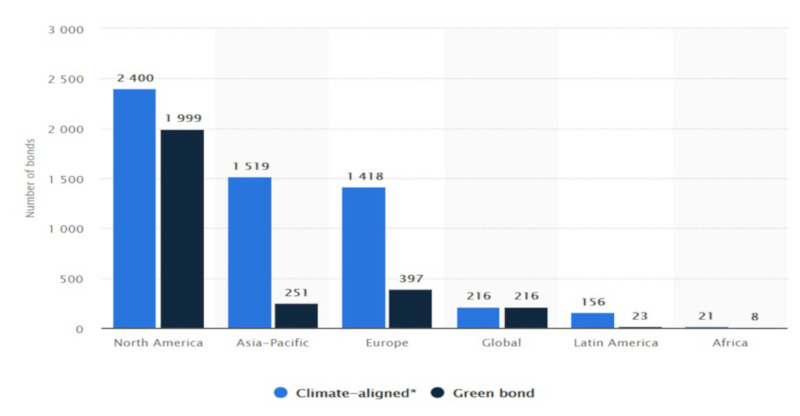

Number of climate-aligned and green bonds worldwide in 2018, by region

Further comprehensive reading on Green municipal bonds - How to Issue a Green Muni Bond: The Green Muni Bonds Playbook (n.p., City Green Bonds Coalition, 2015). 43