Introduction and aims of the document

During the realization of BOOSTEE-CE project, it became clear that municipalities/cities of various countries have different level of knowledge on the energy efficiency as well as the ways of energy efficiency actions financing.

This document is the second towards elaborating “O.T4.1 Transnational EE financing strategy” which will describe how to look for, find and adopt different financing solutions for energy efficiency improvement.

Comparative analysis D.T4.1.1 is defined as Analysis & elaboration of differences among financial schema in partner countries, considering EU grants/funds, possible normative obstacles, investment return, models, etc. The document will also highlight market-enabling actions for large investments.

Comparative analysis tries to summarize the findings of DT4.1.4 i.e. try to summarize and analyze all the information collected by all partner regions. Additionally, it highlights the approaches (strategies and/or practices) towards EE financing which our PPs finds the best.

The comparative analysis is carried out in 5 main sections

- Basic information on the area

- Classification of EE activities and EE funds

- Funding Mix Matrix

- Evaluation of existing experience of EE financing policy implementation in partners regions

- Best practices and investments return models

1.1 Basic information on the area

General overview of each partner ́s region in order to get a concrete idea of what areas/regions are compared

1.2 Classification of EE activities and EE funds

a) Classification of partners EE activities

In this section, energy efficiency activities are analysed and evaluated from the perspective of two basic areas: EE services and EE projects.

‘EE services’ are the core activities which must be continuously provided to fulfil partner ́s EE strategic objectives. These forms may include:

- Development and maintaining energy management

- Energy efficiency central advice service provided by partner

- Training and educational activities in the field of EE

- Monitoring of implementation of energy efficiency policy

- Support citizens / public authorities / companies in the acquisition of EE funds (information dissemination and promotion of co-financing programs and other financial resources)

- Planning and policy (SEAP, SECAP, yearly investment plans, general/city development strategy etc.)

- Changes in behaviour

- ....

‘EE Projects’ are defined as short-term, self-contained activities that augment the EE services, boost the energy efficiency by reducing the amount of energy required to provide services and products. These will come and go over time as project funding, partner’s priorities and the decisions of partner ́s decision making bodies.

b) Classification of EE funds

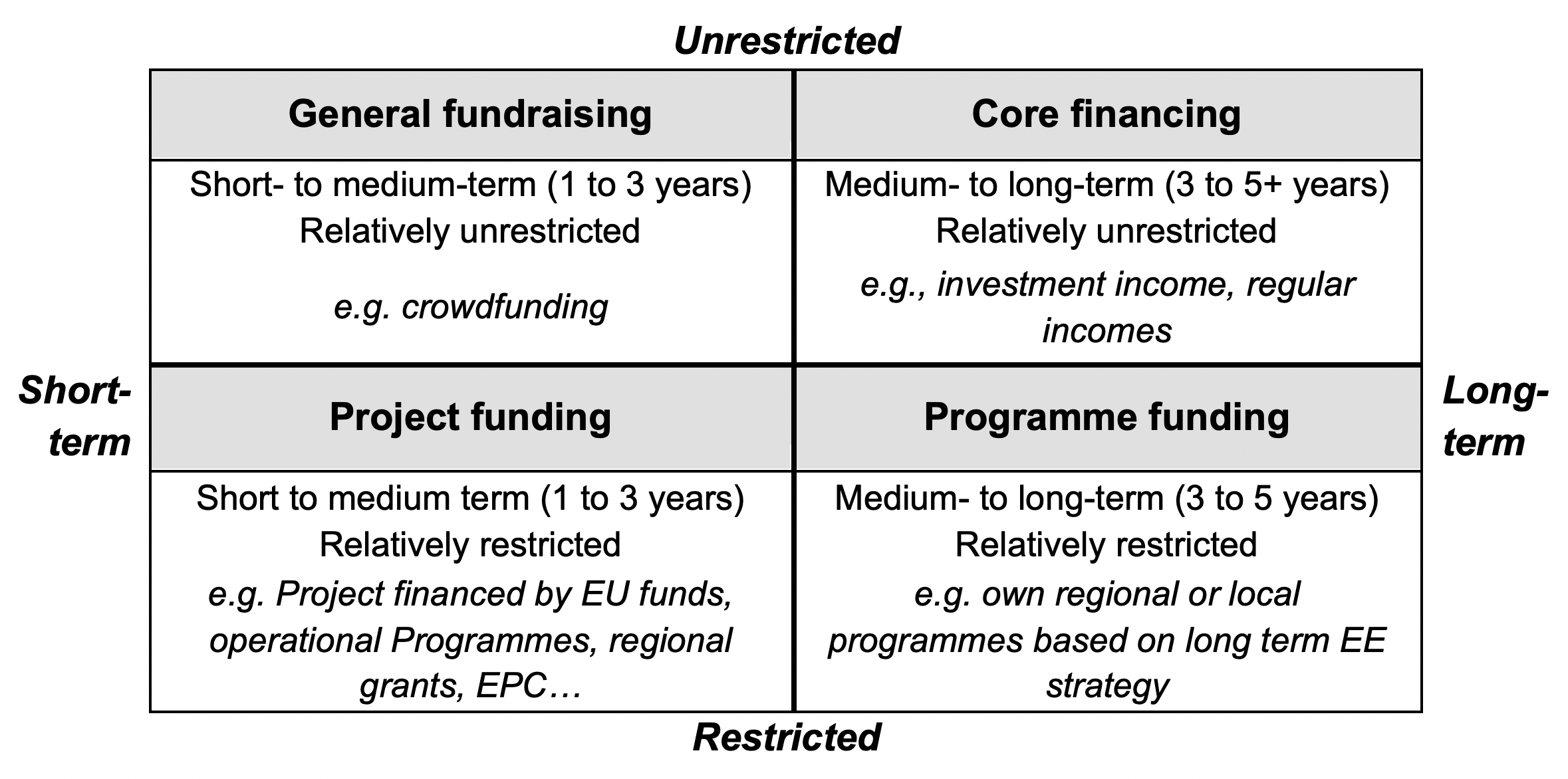

The sources of financing ensuring energy efficiency can be classified according to levels of restriction and the continuity and security of funds. Upon such a classification four categories of EE funds was identified and analysed within each partner region:

General Fundraising

Short-term and relatively unrestricted income, such as events and public donations, crowdfunding etc.

Project funding

Short-term and relatively restricted funds provided by various institutions ranging from local government to EU funding. Being project-specific, these funds generally last for 1-3 years and are difficult to extend which might be leading to a loss of project continuity.

Programme funding

Existing local/regional financing provided by partners to support EE in their regions or areas where a strong working relationship has been established and where grants are based on programme themes, e.g. municipality own energy efficiency fund etc.

Core financing

Regular and flexible income, i.e. partner ́s own resources used to core operation of EE services (projects), not so restricted like programme funding.

Note: This classification focuses on the purpose and temporality. All categories may involve different sources regarding external sources, own sources and loans.

1.3 Funding Mix Matrix

Comparison against following funding mix matrix in each evaluated area provides important information about short and long term planning of EE funding as well as strategy adopted in EE financing in each area compared

Note: This classification focuses on the purpose and temporality. All categories may involve different sources regarding external sources, own sources and loans.

1.4 Evaluation of existing experience of EE financing policy implementation in partners regions

Collection and evaluation of partners ́ practice regarding EE financing policy was carried in a structured way common for all partners. The SWOT analysis was the important part of this section and this analysis was based not only on the experience of BOOSTEE-CE partners but also on a survey with potential main target groups in order to address their needs. The potential target groups in each region/area involved mainly:

- Local public authorities

- Regional public authorities

- Sectoral agencies

- Infrastructure and (public) service providers

- SMEs

- Business support organisations

The common structure of the survey for all evaluated regions:

- Is there any EE financial strategy available for your region?

Name, year of approval. Might also apply just for a section dedicated to EE financing as a part of some other document (SEAP, energy concept etc.) - Who officially approves the EE financial strategy and for how long period?

- Indicative yearly budget for EE financing

- SWOT analysis of both internal and external conditions & environment for EE financial strategy development and implementation

Include the information on a survey with potential main target groups in order to address their needs – see section 1.5., i.e how this survey was carried out and who was questioned.

Internal and external conditions & environment for EE financial strategy development and implementation |

|

Strengths |

Opportunities |

|

-... - |

-... - |

Weaknesses |

Threats |

|

-... - |

-... - |

- Which EE activities are planned to be supported in next periods

According to existing official strategical documents, action plans etc... - Which of the ways of financing energy efficiency investments do you consider the most effective?

- EU funding

- loans / grants from national co-financing programs

- bank loans

- own resources

- other (what?)

- Monitoring process and evaluation of EE financing policy implemented

How do you monitor and evaluate your EE financing policy. Are there any sets of indicators against which is evaluation carried out, evaluation reports etc., please describe

1.5 Best practices and investments return models

Partners delivered various best practice examples of EE financing from their countries upon the following structure.

General:

- Name of the action:

- Time period / year of realisation:

- Description of the action (1500-2000 characters):

- Partners involved

- Key results (300 - 500 characters):

- Success factors identified (300 - 500 characters):

- Barriers / restrictions / obstacles encountered (300 - 500 characters)

- Ways to deal with barriers / obstacles / problems (300 - 500 characters)

- Contact, website

- Pictures enclosed separately

Financial:

It is necessary to complete all the items bellow in order to carry out a relevant investment return model and get at least basic indicators such as NPV, IRR and Ts (simple payback period).

Investment (EUR):

- Overall investment costs:

From that...- Own sources:

- Subsidies (by whom):

- Loans (including interest rate and payment period):

- Lifetime (service life):

- Depreciation period:

Operational features (EUR):

- Annual operational cost incl. salaries, repairs, maintenance and other specific costs:

- Annual revenues – please specify which and how much in EUR:

Such structured best practice on EE financing enabled to compare and understand various ways of EE financing implemented in practice and identify both advantages and disadvantages of each particular EE financing method implemented.